CIO PLAN

THE PLAN

Investment Sought: $250,000

Minimum Investment: $25,000 (or negotiable)

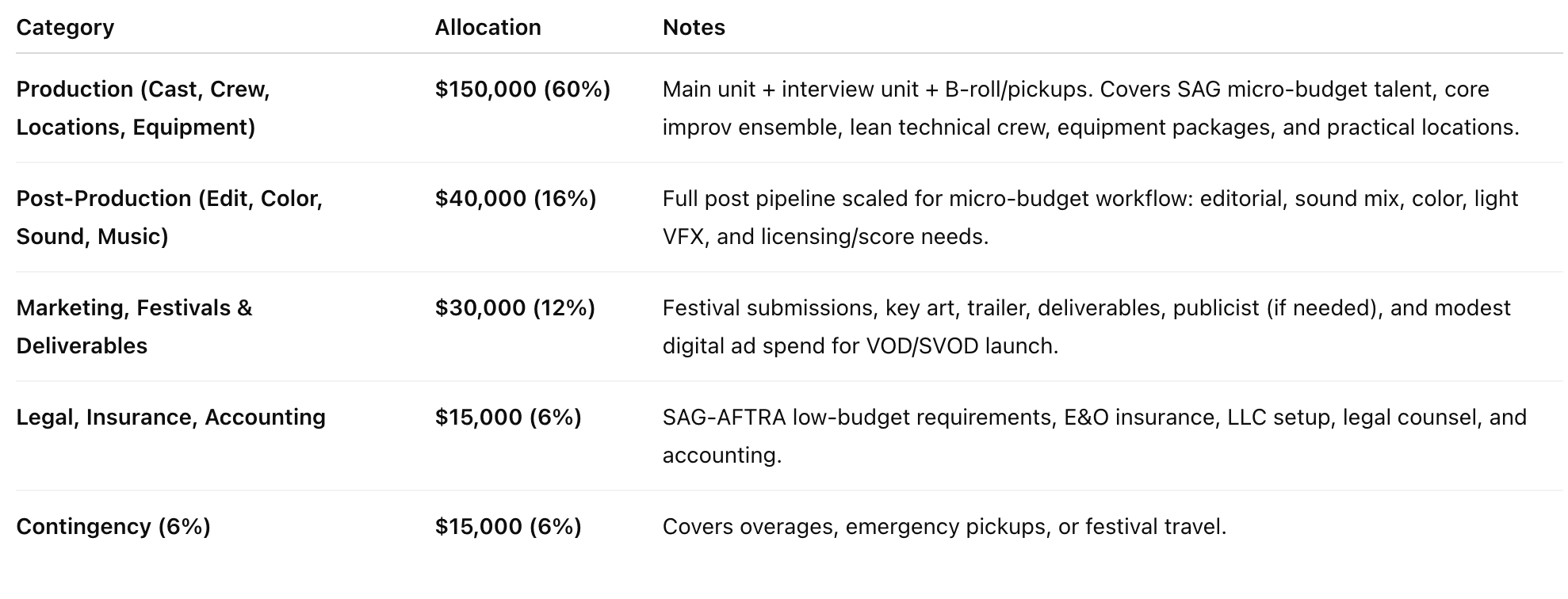

Use of Funds:

Production & Crew – $150K

Post-Production – $37.5K

Marketing & Distribution – $37.5K

Legal & Insurance – $10K

Contingency – $15K

Investor Benefits

First-position recoupment (100% of principal returned before producer profit).

70/30 profit split favoring investors until 2× ROI, then 50/50 thereafter.

Executive Producer or Co-Producer credit on film and IMDb (tiered by investment level).

Festival and premiere access, red-carpet invitations, and inclusion in marketing campaigns.

FINANCIAL OVERVIEW

Equity Budget (Production & Post): $250,000

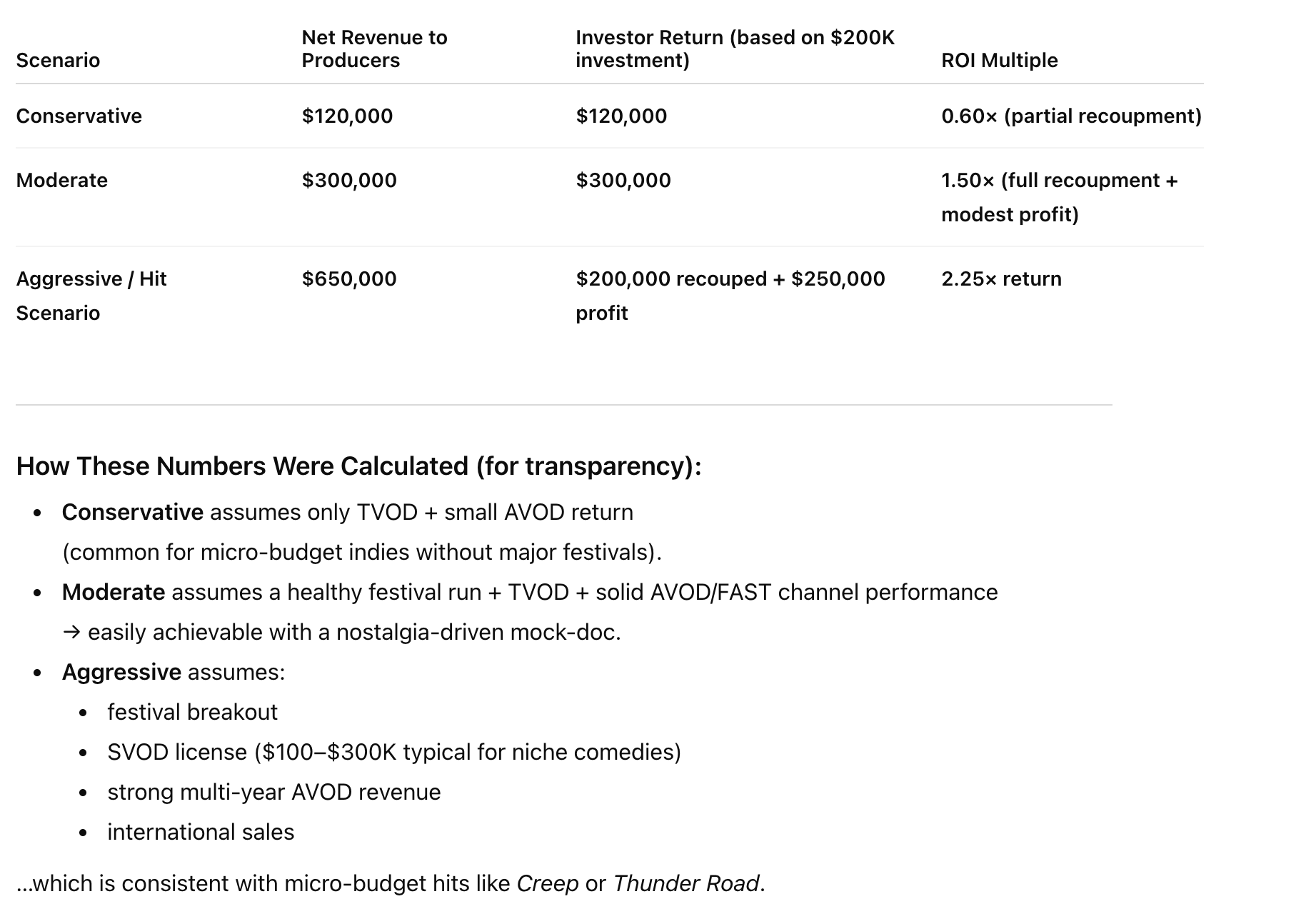

Our goal is to finance the film through private equity investment and to recoup principal plus profit through a combination of festival launch, limited theatrical, digital rental/purchase, streaming licenses, AVOD/FAST, and international sales.

The mockumentary format allows for high audience engagement and festival visibility at a fraction of traditional marketing costs. Every dollar is on screen in performance, concept, and execution rather than big sets or VFX.

PRODUCTION MODEL

Improv-driven mockumentary (Christopher Guest / improv ensemble style)

Structure:

Unit A – Narrative / Ensemble Scenes:

Core story with a tight group of improv-trained actors.Unit B – Talking-Head Interviews:

“Documentary” insert moments, plus recognizable cameos where available.Unit C – Pickups / B-roll / Archive & VFX Inserts:

Faux TV clips, vintage “Cory in Orbit” footage, and connective tissue.

This model supports fast, flexible shooting and scalable name participation without inflating the overall spend.

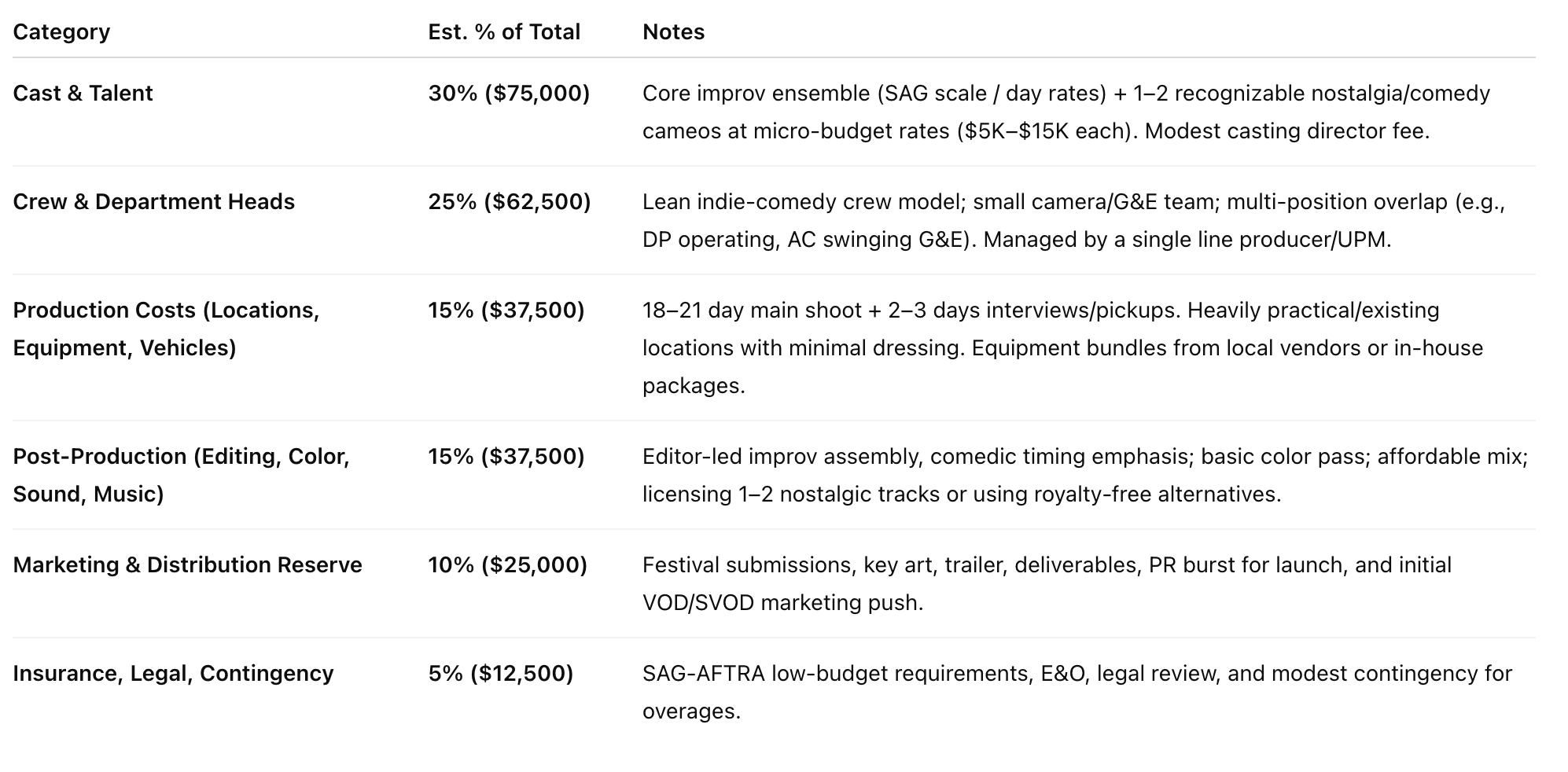

TOPLINE BUDGET BREAKDOWN

CASTING STRATEGY

Core Ensemble (Improv Actors)

Drawn from the UCB / Groundlings / Second City / alt-comedy communities.

Structure: 6–8 core actors working under SAG scale or modest “favored nations” weekly rates.

Ensemble improvisation lets us move quickly: shorter days, fewer takes, more usable material.

Recognizable “Talking Head” Cameos

Because we’re in a micro-budget tier, the strategy is to secure a small number of recognizable faces at contained day rates—prioritizing:

Friends-of-friends, nostalgic TV faces, and cult-comedy performers who resonate with the concept.

One-day, self-contained B-unit shoots to reduce overtime, travel, and scheduling headaches.

Typical indie cameo ranges in this budget band:

Tier 1 Nostalgia / TV Talent: $10K–$20K (1-day commitment)

Tier 2 Cult/Comedy Talent: $5K–$10K

Tier 3 Comedians/Podcasters: $1K–$5K

By concentrating on 2–4 carefully chosen cameos and batching them into 2–3 interview shoot days, we maintain high perceived value without compromising the overall budget.

SHOOTING PLAN

Main Narrative Shoot:

Approximately 18–21 days in and around Atlanta or another incentive-friendly market, primarily on practical locations.Interview Unit:

2–3 days of talking-heads, flexible across 1–2 weeks, scheduled around cameo availability.Pickups / Inserts:

1–2 additional days for faux “TV footage,” vintage gags, and transitions.Crew Size:

Lean 15–20 person core crew, designed for speed and adaptability.Look:

Documentary realism meets warm, nostalgic 90s sitcom polish—a mix of handheld doc and “TV show within the movie” aesthetics.

HOW THIS STRUCTURE SERVES INVESTORS

Keeps total spend around $250,000, dramatically lowering the recoupment threshold.

Multi-unit design maximizes recognizable participation with minimal overhead.

Mockumentary style reduces setup time and shooting ratio, enabling fewer days and lower costs.

Recognizable performances, strong concept, and nostalgia hook increase marketability for streamers and AVOD platforms.

Our hybrid production plan allows us to deliver an elevated, festival-ready mockumentary within a lean $250K framework. By combining an improv-based ensemble shoot with targeted one-day cameos from familiar faces, Cory in Orbit maximizes creative flexibility, minimizes financial risk, and offers compelling value to investors.

INVESTOR STRUCTURE

Investment Vehicle:

Private equity investors participate through the production LLC and are repaid via a “first-in, first-out” priority waterfall.

Waterfall Summary:

Gross Receipts from all sources (domestic & international; theatrical, TVOD, SVOD, AVOD, TV, merchandising, etc.) are collected.

Distributor / Sales Agent Fees are deducted (typically 25–35%).

Distribution Expenses (marketing, deliverables, etc.) are recouped.

Investor Principal is repaid 100% first (first-dollar recoupment).

Profit Participation: After full recoupment of investor principal:

70% to Investors / 30% to Producers until investors reach 2× their original investment.

After a 2× return, profits shift to a 50/50 split between Investors and Producers.

DISTRIBUTION STRATEGY — THREE-PATH MODEL

Plan A — Major Sale / Exclusive Streamer Acquisition

(Best-case festival outcome)

Target: Netflix, Hulu, Amazon, Max, Peacock, or Apple

Route: Premiere at SXSW/Tribeca, secure immediate bidding interest

Typical deal size: $100K–$300K for micro-budget comedies

Benefits to investors: Fast recoupment, strong marketing lift, prestige

Notes: Best scenario for cultural impact + visibility

Plan B — Boutique Sales Agent + International Territory Sales

(Moderate success / typical indie path)

Partner with: Visit Films, UTA Independent, CAA Indie Sales, XYZ Films, etc.

Sell by region:

UK

EU

Australia/NZ

Latin America

Southeast Asia

Combine with: TVOD launch + non-exclusive SVOD deal

Typical outcome: $150K–$500K across 12–36 months

Notes: Most realistic path for micro-budget breakouts

Plan C — Hybrid Distribution (Self-Book Windowing Model)

(If no major buyer materializes — lowest risk / guaranteed monetization path)

Event-style theatrical (L.A., Atlanta, Austin, NYC — + Cory’s nostalgia angle)

PVOD / TVOD launch (Netflix, Hulu, Apple, Amazon, HBOMax)

SVOD pitch to mid-tier streamers (Tubi Originals, IFC, Pluto, Roku)

AVOD / FAST channel rollout

Tubi, Pluto, Roku, and similar platforms

Long-tail ad revenue

Monetization timeline: immediate → long-tail

Notes: Ensures a path to recoupment even without a festival sale

TACTICAL ROLL OUT:

Phase 1 – Festival Launch

SXSW, Tribeca, Austin Film Fest, Atlanta Film Fest, AFI, etc. — targeting critical acclaim, awards potential, and buyer interest.

Phase 2 – Event / Limited Theatrical

Special event screenings and key markets (Los Angeles, Atlanta, Austin, NYC) to generate press, reviews, and a “cult screening” reputation.

Phase 3 – TVOD / Digital

Transactional release on Apple TV, Amazon, and Google Play for early direct revenue and fan engagement.

Phase 4 – SVOD Licensing

Pursue an exclusive or semi-exclusive streaming deal in the $100K–$300K range, consistent with niche and cult-comedy micro-budget titles.

Phase 5 – AVOD / FAST Platforms

Long-tail monetization via ad-supported platforms (Tubi, Pluto, Roku Channel, etc.), which can provide multi-year residual revenue and a constant discovery funnel.

PRODUCTION TIMELINE (Proposed)

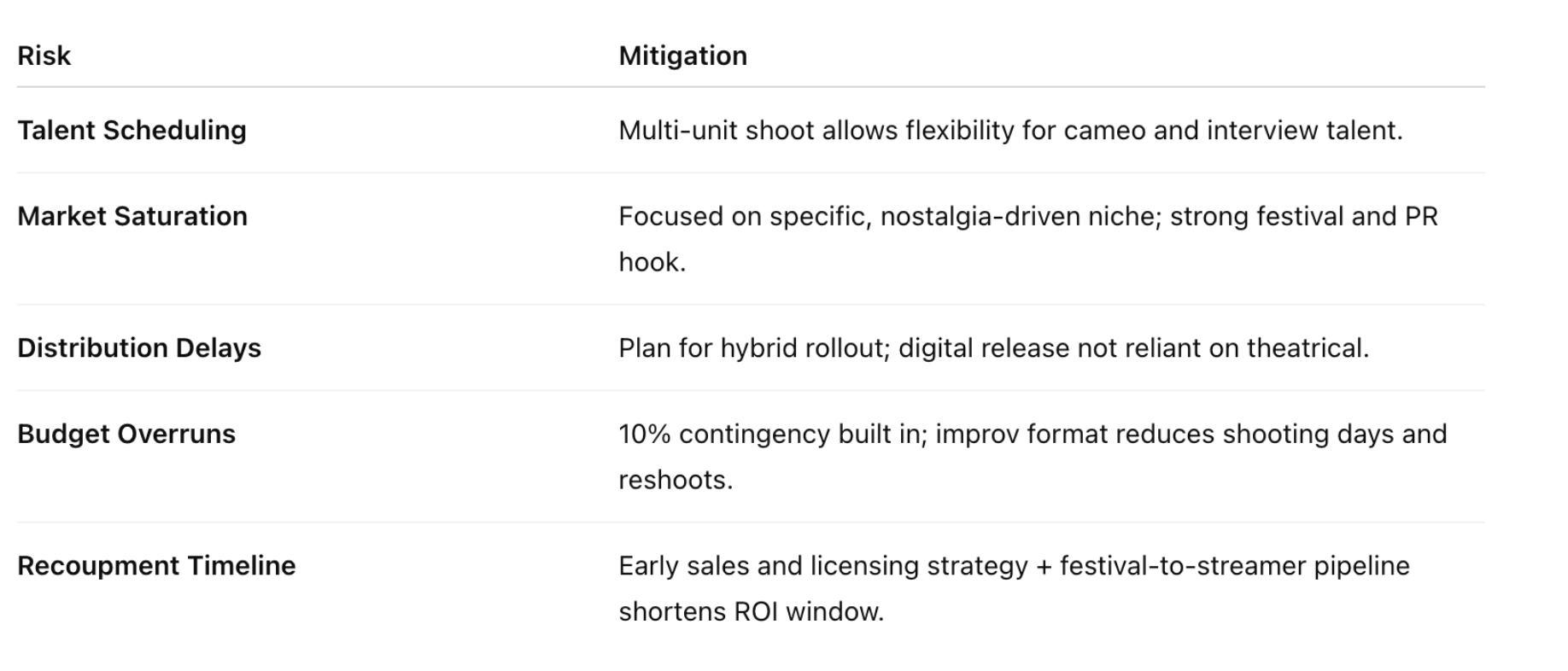

RISK, MITIGATION & INVESTOR UPSIDE

Controlled Budget: A $250K recoupment target is significantly more attainable than a multi-million-dollar spend.

Flexible Format: The mockumentary structure allows us to adjust shoot days, locations, and cameos to fit the actual capital raised.

Multiple Revenue Streams: The plan leverages festival, TVOD, SVOD, AVOD, and international—no single outlet has to “save” the movie.

Built-in Niche Audience: 90s kids, TV nostalgia fans, comedy podcast listeners, and mock-doc lovers.

WHY THIS FILM WORKS

Festival-forward mockumentary with strong modern comps (Thunder Road, VHYes, Bloody Nose, Empty Pockets, Creep).

Affordable, tightly producible outline-based structure that leans on improv, not VFX.

Strong streamer appetite for character-driven, nostalgia-heavy comedy.

Built-in retro / nostalgia fanbase, especially among millennials and former TGIF kids.

High upside / low marketing burn thanks to a concept that’s innately shareable and meme-able (“Did you ever watch Cory in Orbit as a kid… or is that just a Mandela Effect?”).

WHY BACK THIS TEAM

Created by filmmaker Aaron G. Hale, with a strong comedic voice, a distinct brand, and a fully developed pitch deck and execution plan. His (virtually no-budget) short mockumentary film CLEMENTINE swept through the festival circuit and won dozens of awards. CORY IN ORBIT is grounded in real production experience, realistic budgeting, and a practical distribution roadmap tailored to micro-budget success.

NON-FINANCIAL INVESTOR BENEFITS

Producer credit (on-screen + IMDb, tiered by investment level).

Access to set, festivals, and premieres.

Invitations to promotional events and special screenings.

Commercial upside through defined revenue splits.

Participation in a creative, highly marketable cult-film candidate that can live for years on streaming platforms.

IN CONCLUSION

Cory Quaid is gearing up for a comeback — and the movie only happens if the right partners step in. If you’re ready for a smart, funny, festival-ready ride, we’d love to have you on board.

Contact:

aaron.g.hale@gmail.com